There is something of a war surging in the Indian e-cabs market between Uber and Ola – two giants moving forward faster than the wind. They make no qualms about it being a war, as was evident in the recent suing of Ola by Uber. In this article, I’ll illuminate the present condition of this war as it appears to me, first covering a basic overview and then assessing the real site of action!

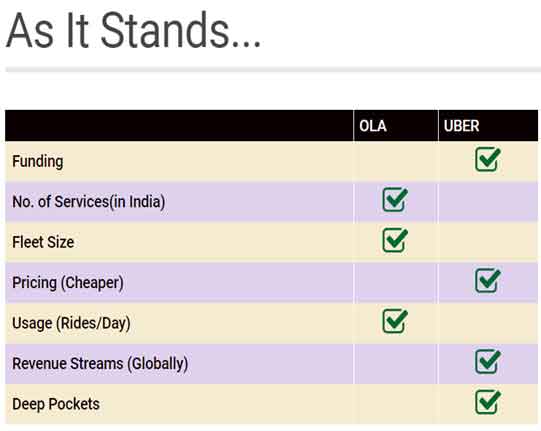

Ola Funding: Appx 1.5 Billion USD. (as of December 2015).

Ola Valuation: As of Dec’ 2015: Approx. 5 Billion USD

Uber Funding : Approx. 10 Billion USD. (as of December 2015)

Uber Valuation (Global): Valuation of Uber as in Dec’ 2015: 68 Billion USD

Services : The Basics

To begin with, let us cover the basics – that is, the nuances in the services offered by the two aggregators.

Both Ola and Uber offer a range of options in terms of vehicle ‘class’ – Sedan, Mini, Prime, Taxi For Sure and Auto by Ola and UberGo, UberX, UberBLACK and UberSUV by Uber. In addition, Ola also offers ‘OlaShare’ – a shared cab wherein you can save 50% of the fare; ‘OlaShuttle’ – a carpooling system for economical daily commute; and ‘OlaCorporate’ – a service for corporates to save upto 60% of the travel expenses of its employees by Ola’s own admission.

In response to ‘OlaShare’, Uber came up with ‘UberPOOL’, which not only allows sharing rides, but also allows a car-owner to ride someone else as an Uber rider. Herein, we see a vital difference between the two approaches – while Ola’s capitalized on Auto-Rickshaws and Shuttles understanding the often befuddling Indian landscape, Uber’s innovation has been clearly inspired by the American market. In addition, both companies launched their respective two-wheeler services in March this year – UberMoto for Rs. 15 and Ola Bikes for Rs. 30 (minimum fares).

In terms of Fleet size, Ola outdoes Uber with their 350,000 cabs compared to the latter’s 250,000. In addition, while Uber’s reach is far more than Ola’s globally, its reach within India spans only 26 cities compared to Ola’s 102.

As for pricing, it is commonly believed that Uber is cheaper than Ola and that is true to some extent. Ola Cabs offers a basic cab at a flat rate of 80 for the first 4 kms and Rs.10/km, a flat rate of 100 for the first 4kms and Rs.8/km, a flat rate of 100 for the first 4 kms and Rs.11/km in Bangalore, Delhi and Mumbai respectively. Uber offers its most basic cab at a base rate of Rs.35 and Rs.7/km, a base rate of Rs.40 and Rs.7/km, a base rate of Rs.45 and Rs.8/km in Bangalore, Delhi and Mumbai respectively. While Uber’s prices are lower by virtue of their massive global valuation, Ola’s much wider reach means that you are more likely to find available Ola cabs than Uber’s on a national scale.

Who’s got more market share in India?

As of 2015, Ola operated with far more daily rides than Uber in India – at least 750,000 (some reports claiming even a million), compared with the latter’s 200,000. While this figure had some substance at the beginning of 2015, things have become very uncertain concerning market share this year and the last, with both companies quoting often contradictory figures (see this livemint article for details).

In August 2015, Ola claimed to possess 85% market share, while Uber, at the same time, claimed to have increased their share from 4-5% to 40%. Soon after, Ola release the ‘Micro’ and claimed that this segment alone will outdo all of Uber’s market share. With the absence of a third-party agency evaluating their claims, the figures thrown about by the two companies seem to be dubious. However, it seems intelligible to conclude that, as of now Ola is leading in terms of rides/day.

Incentive-Model War: The Trojan Horse in the war

The tool that has enabled a heated real-time competition is the war of Incentivization and discounts, which enables the two companies to tweak pricing and incentives for both the drivers and the customers. Let me explain.

Since 2014, when Uber introduced the cab booking app and Ola followed suite with their own, the war between the two companies was primarily fought by attracting more and more drivers to join their fleet. The way both companies make money (the primary way, out of a whole spectrum) is by charging a commission (varies from time to time; generally 12 – 20%) on a driver’s income. The driver keeps the rest of the money and gets an added incentive for completing a certain number of rides a day. In doing so, following the success stories of many drivers, both the companies have managed to attract a huge number of them.

At the same time, the two companies have continued to offer comparatively low prices to their customers, in addition to huge discounts and offers. Combining these two strategies, they have largely succeeded in becoming the major competitors in the market, both at the end of drivers and customers. One might think that this is the perfect model. However, this may not be the case in the long term. As of now, both companies are relying on their massive funding to sustain this model and are probably not turning a profit. Naturally, this can’t go on forever, which means that either the incentives to the drivers will have to be revoked or prices will have to be increased, or both! To add to the complexity of managing this balance, state governments have become watchful of price-surging and increasing prices in general.

The drivers employed by the companies are benefitted by the Incentivization-War, but at the same time, are at its mercy. From personal experience with the drivers, one gets a bifurcated response pertaining to their attitude towards the companies. Some see them as a disciplining factor in their work, which has enabled them to make savings and investments, and others see them as manipulative corporates which treat drivers only as contractors, with little scope of progress. If the incentive-war turns to the disadvantage of the drivers, there is a big possibility that we might see other independent aggregator services come up.

Summing Up…

One must note that this war has just begun and is in no way nearing a conclusion. The rivalry dates back only two years and has since, only seen the addition of newer variables – with governments stepping in, legal battles between the two and grave concerns over public safety, especially in the case of Uber’s regrettable incidents with rape. As it stands, Ola seems to be leading the market in terms of usage, fleet size and a deeper understanding of the Indian local market. However, if the incentivization war is to go on for a while, the last stride will come down to deeper pockets and streams of revenue. If it does come down to that, Ola is well equipped with multiple revenue streams and ever-increasing funding. However, Uber’s global revenue streams are mammoth in comparison, and so is the amount of money they can afford to lose, before they make any in the Indian market. It is too early to call a winner as both seem to be well-equipped and growing. In my personal opinion however, Ola will take the cake in India owing primarily to their ingenious innovations inspired rather observantly from the local Indian market.

Leave a Reply